Real Estate Agent Commissions: New Policies Set to Change the Game

Editorial Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

We may earn a commission from partner links on Newsweek, but commissions do not affect our editors’ opinions or evaluations.

The Class Action Lawsuit against the National Association of Realtors

In 2023, more than 20 lawsuits were filed against the National Association of Realtors (NAR) and several real estate brokerages, claiming that the policy of “cooperative compensation” unfairly boosted commission rates. The NAR settlement agreement, which has preliminarily been approved by a judge and is likely to be finalized in November 2024, offers compensation of $418 million along with policy changes.

Policy Changes as Part of the Lawsuit Agreement

Two main policy changes that are part of the lawsuit agreement will be implemented this summer even before the settlement is finalized, according to NAR. The biggest change for homebuyers is that they should no longer assume the commission for their buyer’s agent will be automatically deducted from the seller’s side of the transaction at closing.

Options for Homebuyers to Consider

There are multiple options for buyers to consider, such as:

- Paying their buyer’s agent out of pocket

- Negotiating a commission rebate with their buyer’s agent

- Working with a flat-fee or discount real estate brokerage

It remains to be seen how buyers adapt to new commission practices and whether sellers will continue to offer cooperative compensation during negotiations.

The Decision for Sellers: Whether to Offer to Pay Their Buyer’s Agent

Sellers and their agents won’t be able to advertise commission information on the MLS, but they can still offer to contribute to the buyer’s agent’s fees privately. Unless homeowners choose to sell their property themselves, the relationship between the sellers and their listing agent will remain the same. Sellers can negotiate with their agent to determine how much the commission will be for selling the property or pay them a flat fee for specific services.

Options for Sellers under the New Commission Policies

Options for sellers under the new commission policies include:

- Offering a fixed commission rate to their listing agent

- Negotiating a lower commission rate with their listing agent

- Working with a flat-fee or discount real estate brokerage

How sellers handle commission payments is likely to depend on local market conditions. If there are few homes for sale and an abundance of buyers, sellers have less incentive to offer to pay a buyer’s agent commission. They’re likely to feel they can attract buyers without needing to entice them by offering to pay their agent’s commission. But if markets shift and sellers face more competition, homeowners may decide they would rather pay the buyer’s agent’s commission instead of dropping their price. Buyers may be more likely to ask for that fee to be paid during negotiations if they have plenty of other properties to buy.

The Impact on Real Estate Transactions

Real estate agents are not a mandatory part of any real estate transaction. But just 7% of real estate transactions in 2023 were For Sale By Owner, according to the National Association of Realtors’ 2023 Profile of Home Buyers and Sellers, and 89% of both buyers and sellers hired a real estate agent to help them. As real estate commissions become more transparent, buyers and sellers may choose to reconsider the advantages and disadvantages of hiring an agent.

The Average Real Estate Salary and Commission Rates

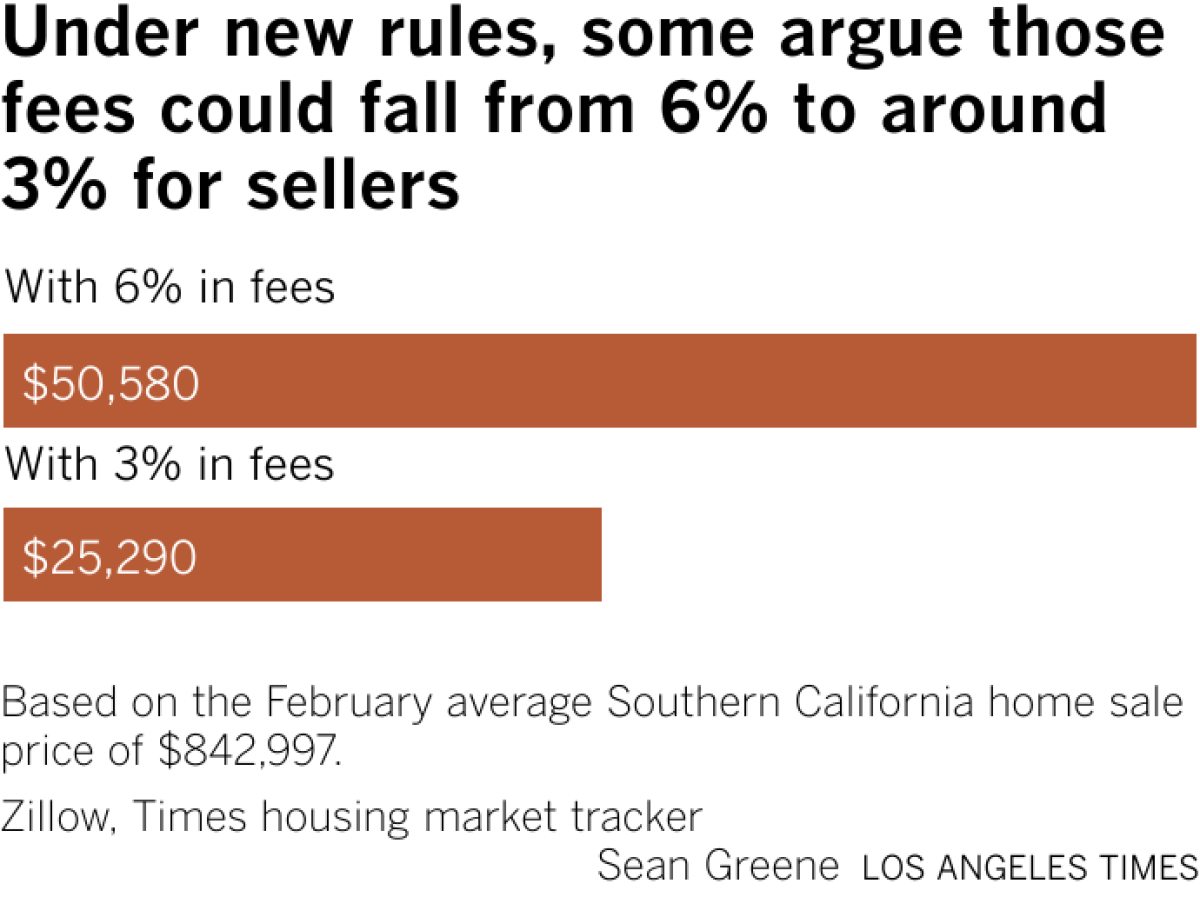

While estimates vary according to the source, Salary.com says the average real estate salary was $46,191 in March 2024. Real estate commissions typically range between 2.5% and 3% of the sales price per agent, which the agent shares with their broker.

Payment to Real Estate Agents through a Mortgage and VA Loans

Under current rules, most lenders are not allowed to finance payments to real estate agents with a mortgage. Some industry experts advocate changing that practice to make it easier for buyers to pay their agents. Veterans and active members of the military who finance their home with a VA loan are prohibited from paying a commission to a real estate agent. Unless the rules change, VA borrowers won’t have the option of working with a buyer’s agent.

Conclusion

Despite the policy changes resulting from the class action lawsuit, many elements of the typical real estate transaction will remain the same. Commissions can be negotiated by home sellers with their agent and by homebuyers with their agent. The impact on first-time homebuyers and buyers with low-to-moderate incomes remains to be seen, and it will be interesting to observe how they adapt to and navigate the new commission practices.

At Newsweek Vault, our team of dedicated writers and editors are not just experts in their respective fields but also committed to delivering content that meets the highest standards of journalistic integrity. We analyze primary sources, including peer-reviewed studies, authoritative government sites, and insights from leading industry professionals and ensure that every piece of information is researched, fact-checked, and presented with accuracy and relevance.

Originally Post From https://www.newsweek.com/vault/mortgages/what-the-nar-legal-settlement-means-for-homebuyers-and-sellers/

Read more about this topic at

The future of real estate commissions post-Realtor settlement

6% commission fees for real estate agents are going away. …