Trump’s Legal Fees and Tax Deductions: A Comprehensive Analysis

An Introduction with Disclaimers

Donald Trump, the likely Republican nominee for president in the upcoming election, is facing a number of civil and criminal lawsuits containing a variety of claims. His legal fees are likely to be yuge but they may reduce his tax bill to his usual $750. So let’s look at the most publicized lawsuits and criminal indictments involving Trump and whether the associated legal fees are tax deductible.

Since Trump is a very divisive topic, I should add disclaimers. First, I have no direct knowledge of any of these cases other than what is publicly available. There may be nonpublic facts that could change the outcome of the analysis. Second, I have no opinion on the merits of any of these lawsuits, and my conclusions do not imply a position one way or another.

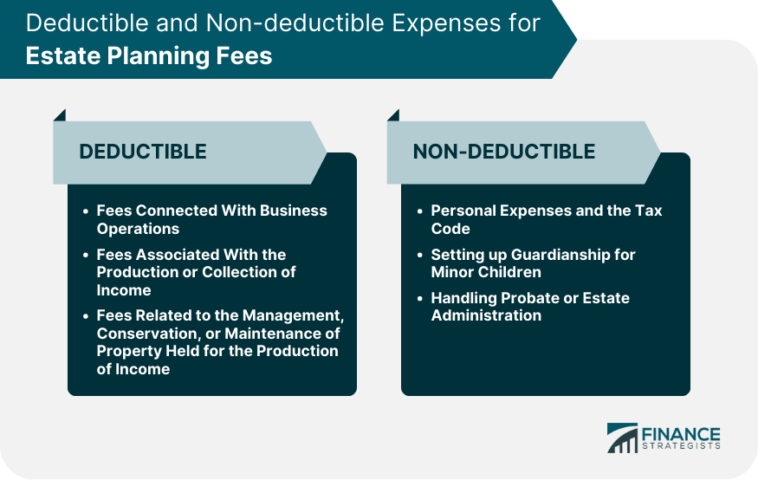

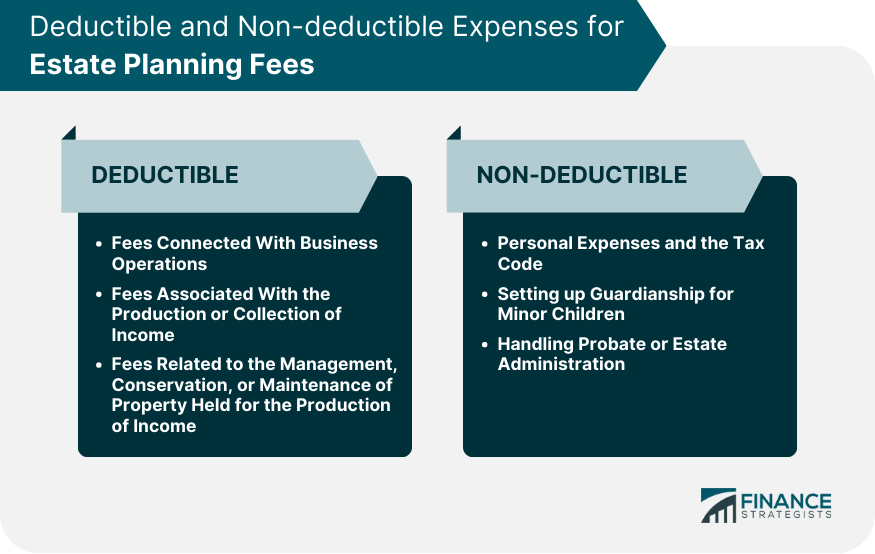

Legal Fees as Business Expenses

Whether legal fees are deductible generally depends on the nature of the matter. Legal fees connected to business activities are deductible as a business expense. If the fees are connected to the acquisition of capital assets or real estate, the legal fees are not fully deductible but must be depreciated over a number of years. If the legal fees are personal in nature, such as personal injury or divorce, the legal fees are not deductible. But there are exceptions to these rules so it may be best to consult a tax professional before forking over the large retainer.

The Origin of the Claim Test

What if the legal fees are connected to personal and business issues? To address this, courts use the “origin of the claim” test to determine deductibility. As the name suggests, the courts look at the origin and character of the claim that necessitated the payment of legal fees. This test does not care about the outcome of the dispute. For example, legal fees paid for divorce are not deductible even though the proceedings may involve splitting of jointly owned business assets or division of business income between the soon to be exes. Lastly, a person must actually pay the legal fees to be deductible. While this sounds obvious, in Trumps’s case, the Republican National Committee has paid a significant portion of his legal fees. So Trump cannot claim the deduction if the RNC paid it.

Trump’s Attorney’s Fees Related to Business Activities

Currently, there are two lawsuits that accuse Trump of interfering with a presidential election. The first is at the federal level where Trump is accused of inciting riots on January 6, 2021, with the goal of preventing the certification of the 2020 election results. It also accuses then President Trump of enlisting fake electors, and pressuring Vice President Mike Pence and members of Congress to not certify the results of the 2020 election.

The second lawsuit comes from the state of Georgia where Trump is accused of pressuring Georgia’s secretary of state to overturn the election results. Another federal lawsuit accuses Trump of willfully retaining classified documents, obstructing justice, and making false statements. These lawsuits are related to Trump’s conduct while he was president and running for re-election.

The president is a government employee and not a business owner or independent contractor. Therefore, his attorneys’ fees are considered employment-related expenses which used to be an itemized deduction. However, the Tax Cuts and Jobs Act (TCJA) disallowed the employment-related expense deductions from 2018 to 2025. Even if the pre-TCJA tax laws were to apply, Trump’s supposedly huge income would have subjected him to the alternative minimum tax (AMT) which adds back most itemized deductions to taxable income. Indeed, when Trump’s tax returns were leaked, it showed that a sizable portion of taxes paid were due to the AMT.

The E. Jean Carroll Defamation Lawsuits

E. Jean Carroll sued Trump twice for defamation. In the first lawsuit filed while Trump was president, Carroll claims that she was defamed when Trump made a statement denying her sexual assault claims and accusing her of trying to publicize her book. In the second lawsuit filed after Trump’s presidency ended, Carroll claims she was defamed due to Trump’s statements on Truth Social in addition to battery.

In the first lawsuit, Trump had no attorney fees because he was represented by Department of Justice lawyers while he was president. The second defamation lawsuit is a little trickier because Trump may argue that protecting his reputation against a defamation allegation is connected to the production of income both as a businessman and as the Republican nominee for president. But because the defamation lawsuit originates from claims of sexual assault, Trump’s legal fees to defend the defamation lawsuit is not likely to be tax deductible.

The Hush Money Indictment

In 2023, Trump was indicted in New York for paying hush money to adult actresses Stormy Daniels and Karen McDougal to prevent them from publicizing their past extramarital affairs with him. Trump is accused of falsifying business records in order to cover up the payments.

It may be argued that since the indictments involve falsifying business records, the lawsuit is business related and so the legal fees are tax deductible. But on the other hand, these payments were made in connection with personal activities that had no connection to Trump’s businesses. Since the origin of this indictment involve Trump’s personal activities, the legal fees are not likely to be tax deductible.

Conclusion

In conclusion, the tax deduction of legal fees paid for civil or criminal lawsuits against Trump depends on various factors such as the nature of the matter, the origin of the claim, and the characterization of the legal fees as business or personal expenses. It is therefore important to consult a tax professional before making any deductions.

Legal document automation is no longer only for the exclusive few. In this CLE-eligible webinar on April 10th, we’ll explore the most common accounting pitfalls and how to avoid them for your firm. Findings from the “Future of Professionals Report,” based on a survey of 1, 200 professionals from North and South America and the UK. Lexis Create provides simple access to internal and external knowledge — directly within Microsoft Word. Above the Law daily newsletter Sign up and get the latest news in your inbox. If lawmakers could free up $250 million in the FY25 budget, the service could use that to purchase two additional CH-53K helicopters, or $341 million could be used for the Amphibious Combat Vehicle 30mm Cannon (ACV-30) line. It turns out Donald Trump cannot hold a candle to whatever Joe Biden is doing. Searching for a law school where you’ll be truly valued for who you are as a person? Look no further.

Originally Post From https://abovethelaw.com/2024/03/are-trumps-legal-fees-tax-deductible/

Read more about this topic at

Trump Can Write Off $83.3 Million Verdict, Carroll Pays Tax …

Trump must pay legal fees for Steele Dossier lawsuit